Small or medium size enterprise (SME) is one of the most important economics growth factors having the basic impact on the general development of the country’s economy and social stability, creation of new work places, therefore its development is one of the most important country’s economic politics’ trends.

Small or medium size enterprise (SME) is one of the most important economics growth factors having the basic impact on the general development of the country’s economy and social stability, creation of new work places, therefore its development is one of the most important country’s economic politics’ trends.

In the theoretical part of the article there have been identified two scientific approaches towards SME‘s support. Some scientists think that the SME’s support is unjustifiable, because government intervenes into the dictated processes of the market and violates them, but the other part claims that the SME’s support politics implemented by the government helps to solve business and economics’ problems. Both sides have their own arguments, but those are more marginal approaches. Currently, the Lithuanian government supports SME’s stimulation, support and versatile help, but in reality due to financial resources' lack small or medium size enterprise is maintained according to resources.

When Lithuania became the EU member, there emerged more possibilities for small or medium size enterprises, opening new vistas for business people. A number of the provided projects shows that the required support sums are exceeding funds possibilities. Therefore it is important to base the need for the support of a particular company.

In the article there have been analyzed the European Agriculture and Guarantees’ Fund (EAGF) requirements, which the enterprise must correspond in order to get the EAGF support. One of the main requirements is that economic vitality rates (general liquidity rate, the net profitability, loan repayment rate, loan rate, the internal repayment rate, the average asset profitability) corresponded to the set critical values.

In the investigative part of the article there have been carried out the activity development analysis of the JSC “Kaimas” in order to get the support of the EAGF. While validating the support’s need there has been oriented to economic vitality rates and their impact on the company. There has been carried out the analysis of the planned economic activity, risk factor and financial commitments. The need for additional financial support has been also analyzed. There has been estimated that investments could be financed from private, loan’s and the EU support funds. There have been grounded the company’s manufacturing equipment modernization possibilities while purchasing the needed long-term assets. There has been estimated that part of the company’s production is to be exported. It is forecasted that manufacturing outlays (materials, energy) would increase 10 per cent annually. The company loan servicing, economic vitality and investment effectiveness, and manufacturing self-cost statistical tables have been prepared.

The analyzed main economic enterprise rates allow to claim that the project is viable and financially useful and paying off. The received economic vitality rate values are better than the critical values; therefore, JSC “KAIMAS” is a suitable applicant for the EAGF support. The carried out calculations show that the forecasted activity programs’ implementation will guarantee that the activity would be profitable and will allow to implement the allocated investments for economy modernization.

Introduction

The research topicality and novelty. The experience of the developed countries shows that small or medium size enterprise (SME) had a great importance for economic growth. In 2003, SMEs made 99.8 per cent of all the EU non-financial sector enterprises (Kriščiūnas, Greblikaitė, 2007). Low demand of capital, quick reaction to the market changes and flexibility while adapting to them, new markets or filling of niches, creating competition for state enterprises, servicing big enterprises, creating new and frequently higher quality products, services, manufacturing processes – these are the main advantages of small or medium size enterprises revealing their effectiveness and importance.

These features stimulate the state’s support for small and medium size enterprises. However, many theoreticians and politicians object to this approach stating that support of a small or medium size enterprise is unjustifiable, because the government intervenes into market economic processes and violates them.

The researches about effective state support for SME are essentially important in Lithuania now, because most SME enterprises which invest into manufacturing modernization and plan new manufacturing activities seek to get the EU structural funds’ support. Therefore there emerges the problem of grounding support for the enterprise.

The planned research problematic question is the following: how is it possible to ground the planned SME enterprise activity and provide the project so that there would be clear for estimators that:

- the project without support would not be implementable or would be implemented with the lower volume and slowly;

- the project does not quickly pay off and is exceptionally profitable;

- the enterprise is capable to implement this project, i.e. the project would be viable;

- the support would be effective according to the state’s economic policy.

The research object: possibilities for SME enterprise and their implementation.

The research aim – to investigate the support for SME enterprise possibilities and ground their implementation.

The research tasks:

1. To analyze scientific-economic approaches to SME financial support necessity.

2. To analyze the Lithuanian state’s approach to SME importance for the state’s economy and its support.

3. To carry out “Kaimas” activity expansion analysis.

4. To ground the support reception for JSC “Kaimas” possibilities.

The research methodology The research has been carried out according to three conditional levels: scientific, state and enterprise. There has been analyzed science literature about SME support, a declared and real approach towards SME support. At the enterprise level there have been analyzed the EU structural funds’ support for the particular enterprise. There has been proved that a particular enterprise needs investments, that the enterprise could not get the needed support from other sources, also that the enterprise would be capable to implement the needed degree project of a required degree. It is essential that the project would not be conditionally quickly payable off, “exceptionally” profitable, and it must be little venturesome.

The scientific aspects of support for business

The scientific aspects of support for business

Small or medium size enterprise (SME) as one of the economics’ part, even phenomenon, has been investigated by well-known scientists (Armstrong, Taylor, Horn, Hardwick, Khan, Langmead, Mises, Hali, Smith, Tsoukalis, Ross, Westerfield, Jaffe, Nef, Schiemann). Currently in Lithuania there is a popular theory of the famous economist and market economics analyst – Horn’s theory. Lithuanian scientists quote Horn in their publications analyzing SME and especially emphasizing its support significance.

According to Horn, a small or medium size enterprise is one of the essential parts of viable market economics. However, the SME expansion is not possible without the state’s maintenance and support. Small companies’ problems are not identical to the problems of large companies; besides, small or medium size enterprises have many difficulties while getting into financial markets.

The main task of the SME with orientation to expansion is the following: to carry out the expansion strategy using the most effective way (Armstrong, 2000).

In order to solve these problems there is the need of additional financing, therefore it is essential to solve them using the state’s level. According to Horn, it is essential to create the state’s initiated SME support organizations, which would provide not only financial, but also technical and organizational support for SMEs.

Many scientists in Lithuania stress the effectiveness of public and private sectors’ partnership (Skietrys, 2008).

There is written in the Lithuanian SME development strategy until 2015: “small or medium size enterprises most sensitively react to all changes of the business environment. They suffer firstly, if they are crushed with too big bureaucracy, the taxes’ burden, market’s changes, they firstly flourish due to initiatives, encouragements and the success recognitions”. Therefore there could be agreement with Horn’s theory and it could be hoped that it would be implemented practically (Stripeikis, 2004).

There are many scientists contradicting to Horn’s theory. The state allocating many funds for SME, distorts the market and creates uneven competition conditions. It contradicts to the free market theory, where there is stressed the minimal state’s role in the business sphere.

Approaches to small or medium size enterprise support

There dominate two approaches to the SME’s support.

Approach 1: Small or medium size enterprises support is unjustifiable, because the state intervenes into the market’s dictated economic processes and violates them.

This approach has been given in the works of the free market theoreticians: Mises, Hayek, Rothbard, Gouriet. This approach is given by the Lithuanian Free Market Institute experts: Leontjeva, Trumpa, Vainienė, Bagdzevičienė, Baršauskas, Sūdžius.

Those sticking to this approach claim that all subjects must act according to the equal conditions and must not be discriminated or supported using exemptions or privileges.

The “Austrian” economic school patriarch L. Mises states, “any state’s intervention into the market processes, looking at them from the touched citizens’ eyes could not be qualified otherwise as confiscation or as giving freedom”. Here usually one individual or an individuals’ group get wealthier free of charge. In most cases damage inflicted on other people does not weigh up the benefit for other people (Mises, 1992). In his opinion, the state should not interfere into the market’s processes. There could be relieved circumstances for new companies to get into the market and compete there.

Hayek states: “if we leave for someone else outside the market the right to decide what is more useful for society and allow to stimulate this activity, we violate the correct competition’s principles and create soil for the state’s interventionalism “ (Degutis, 1997).

The Lithuanian Free Market Institute spreads economic liberalism ideas based on the free market and the limited power principles. Leontjeva states that in the support for SME it is not explained “using whose account it will be done – who will pay the needed taxes for support, whose common needs financing would be refused, who will take the burden on one’s shoulders, the weight of the exemptions given away”. The author proposes to eliminate the state’s intervention into the market.

The Swiss scientist Nef writes about the EU less developed regions’ support implemented through the SME’s support programs. According to his statement, the EU does not say against the free market, but its laws are violated. To get more as possible foreign support looks better only during the first 5-10 years. Due to the increasing dependency the foreign support could become dangerous for the state.

It could be seen that the free market supporters state that the SME support is the negative influence of the state on the laws functioning in the market when goods created by some are distributed for others, so increasing the state’s as the market regulator’s role in the country’s economy.

Approach 2. The state’s implemented small and medium size business support policy allows to solve business and economics problems.

Economic SME’s role in the country’s economy is stressed by Mueller, Saveljeva, Keins, etc.

In the study “ The State in the Changing World” of the World Bank published in 1997, there is also given the approach that the state could better and most reliably solve the economics problems (World Development, 1997).

Snieška who carried out the Lithuanian business structure development tendencies’ forecasting evaluation, concluded that unfavorable business functioning conditions especially burden effective business development in the peripheric regions (Snieška, 2008).

Melnikas while proposing the Eastern and Western European processes transformation systemization and classification scheme paid attention to the fact that great impact is made on the business not only by states, but also on the international politics (Melnikas, 2007).

Economists who stick to the second approach mention experience of foreign countries. They state that the state’s active participation, wise regulation and cautious protection could be effective. The carried out statistical researches in the Western Europe show that though half of small and medium size enterprises bankrupt already during the first year of their existence, the remaining ones during the other three years create averagely from 2 to 6 job places and in 5 years – 3-8 new job places.

While Lithuania gets to the market economy, the free market supporters propose to reduce the state’s influence on economics, let the market decide what is useful, but, “we are surrounded by other countries having their own interests. We strongly feel their influence. Therefore, it is essential to create rules of the game, create infrastructure, and attract investments (Masalskis, 1998).

The state’s approach to the SME’s support

The EU countries seek to create equal and frequently more favorable conditions for small business people for competition on the market than for large companies (Bivainis, 2001).

In the economically developed world countries small and medium size enterprises make up about 95-99% of all national enterprises, and the greater part of the country’s created national product belong to them (Let SME’s Grow, 2005). These companies strengthen the region’s economy, positively influence the infrastructure and quickly assimilate novelties.

However, without the creation of the appropriate conditions, these SME advantages are only potential and bring exceptionally less benefit for the country’s economy than they could. Therefore in the world there is emphasized the governmental business support policy, entrepreneurship organization and legalization, the business activity regulation, creation of business infrastructure model (Global Transformations, 2002).

Both analyzed scientific approaches are mirrored in the Lithuanian SME development strategy until 2015. Matekonienė, the head of the strategy work group, claims: “The greater government’s intervention, regulation, application of contradictory normative acts – the angular reason, which restricts small and medium size business people’s freedom. The complicated and nontransparent business environment creates conditions for the spread and development of corruption (Trebuňa, 2008).

The abundance of SME enterprises is the growing, “healthy” economics’ sign. At the end of 2007 there were about 56 thousand functioning SME enterprises in the country. In the Lithuanian SME’s development strategy till 2015 there is stated that SME is one of the most important trends of the Lithuanian economic politics (Čambál, 2008). The main SME’s weaknesses: the depreciated machinery and the old manufacturing equipment, and the lack of the support means applied to the starters and developers of a small and medium size enterprise.

The EU limited support policy for SME seeks to create favourable conditions for SME to function not only in the countries’ national, but also in the international European market. Currently in the Eureopean countries there are 3 main ways of financial support for SME’s:

a) credit guarantees;

b) the subsidized loans;

c) grants, direct subsidies.

The most popular way is the credit guarantees. The aim of them is to let SME enterprises borrow money from the commercial systems according to favourable conditions, even not having the needed deposit (SME’s in Europe, 2003). Besides, the state can alternatively borrow funds for SME enterprises through the specialized financial institution or the commercial banks’ system. Thus, the loan is given only according to the goals approved by the state: the environment control, development of high technologies’ industry and the development of problematic regions (Business Vision for Europe, 2005, Baňasová, 2010).

In the EU countries two tendencies of SME’s policy are present:

- business law and economic environment are constantly improved, regulation is reduced, business conditions are liberalized, the services and functions offered by the state are privatized, competition laws are improved and the tax system is reformed.

- There are created new SME’s programs, financial support and SME’s development means. They are for the growth of enterprises, stimulation of subsidies.

SME enterprises can get support from the municipalities SME’s support funds (in 2007 there were allocated funds of 5 mil. Lt).

There is needed the enterprise’s financial input for the EU financial support. The structural funds support is allocated not to change the state’s expenses for certain sector, but also to complement them (Gečas, 2004).

Economy vitality rates

According to the economy entities, who seek to use the general programming document Village Development and Fishery priority support, economic vitality estimation rules, approved by the law No. D-64 of February 8, 2005 of the Minister of the Agriculture Ministry of the Republic of Lithuania, there have been foreseen the following rates describing economic vitality:

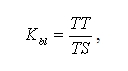

General liquidity rate – the short term assets and the short term commitments ratio, showing the economy’s ability to implement short term commitments according to the available short term assets:

here TT – short term assets, Lt; TS – short term commitments.

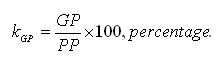

The net profitability - the net profit and the sales’ income ratio showing how much profit of the economy’s net profit is for one Litas of the sold production (services):

here GP- net profit, Lt; PP – sales’ income including income subsidies, Lt.

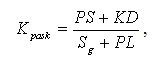

The loans’ repayment rate – the main activity and the capital’s subsidies’ form received money flow ratio with the repaid loan and the paid interests during the period, which shows the economy’s ability to repay the loan or part of its funds received from the main activity:

here PS – the main activity money flows during the period, including income subsidies, Lt, KD – the received capital subsidies during the reporting year, Lt; Sg – the repaid loans and the paid lease payments during the period, Lt; PL – the paid interests during the reporting period, Lt.

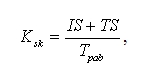

The loan’s rate – short term and long term loans’ (payable sums and commitments) ratio with assets showing what part of assets is financed using the borrowed funds and reflecting financial risk:

here IS, TS – accordingly farmers’ short tem and long term loans (agricultural enterprises (cooperatives) and other enterprises’ payable sums and commitments), Lt; Tpab – value of all assets in the end of the reporting period, Lt.

Internal profit rate – the discount norm, in the presence of which the invested capital’s value is equal to the ready money flows’ value. The internal profit value (VGN) is calculated according to values:

VGN = IRR (-LV0; PS1; PS2; PS3; PS4; PS5 + LV5),

here: LV0 – the economy subject (chosen for development activity sphere’s) assets remaining value before investment (short term assets + stocks + received sums – debts to suppliers and the received precedent payments), Lt; PS1, PS2, PS3, PS4, PS5 – appropriate forecasted years’ ready money flows; LV5 – the assets’ remaining value for 5 forecasted years, Lt.

If the projects’ financial internal profit rate is higher than 20 per cent, the projects are not financed.

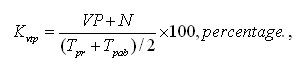

Average assets’ profitability – the activity’s profit and the average assets during the period ratio showing how much of the economy’s activity profit is allocated to one balance assets’ value in Litas.

The average assets’ profitability for the enterprise is calculated in the following way:

here VP – the enterprise activity profit (loss), while subsidising, Lt; N – short term assets depreciation and amortization inputs, Lt; Tpr and Tpab – value of all assets appropriately at the beginning and at the end of the period, Lt.

The project’s vitality rate must be grounded calculating economic vitality rates, which must not exceed the marginal values.

Analysis of the economic activity rates’ of JSC “Kaimas”

Short term financial commitments JSC “Kaimas” for financial institutions made 451 thousand Lt at the beginning of 2006. The total enterprise’s project additional financing need is 800 thousand Lt. There is needed the bank’s loan of the same size for 8 years, while paying back in equal parts annually 100 thousand Lt. 525 thousand Litas of 1.180 thousand Litas project implementation expenses would be financed using the loan received from the bank. The part of support received from the project’s second stage investments would be used for loan’s partial repayment.

Table 1: Loan service

|

|

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

|

Net profitability |

10.9% |

17.1% |

8.5% |

7.0% |

11.6% |

12.0% |

|

Average assets’ profitability |

16.7% |

17.5% |

12.8% |

11.4% |

13.6% |

14.9% |

|

Loans’ rate |

0.46 |

0.44 |

0.40 |

0.36 |

0.31 |

0.24 |

|

Loans’ repayment rate |

1.50 |

1.71 |

1.19 |

1.12 |

1.32 |

1.34 |

|

General liquidity rate |

0.97 |

1.71 |

2.48 |

2.44 |

2.45 |

3.30 |

There have been used financial coefficients, which allow to forecast the enterprise’s vitality and the project’s resultativeness for the enterprise activity’s effectiveness having implemented the project.

Table 2: Economic vitality of JSC “Kaimas”

|

Loans, thousand, Lt |

2006 |

2007 |

2008 |

2009 |

2010 |

|

Loans in the beginning |

451 |

774 |

924 |

724 |

524 |

|

Loans’ collection |

450 |

350 |

- |

- |

- |

|

Loans’ repayment |

127 |

200 |

200 |

200 |

224 |

|

Loans’ payment |

34 |

57 |

55 |

43 |

31 |

|

Loans in the end |

774 |

924 |

724 |

524 |

300 |

While evaluating the enterprise’s economic vitality for the forecasted period the following premises have been accepted: 1) all manufactured production would be sold, therefore the annual realization volumes are equal to the production volumes; 2) packing and solid fuel production realization prices would not increase more than 2 per cent annually; 3) investments would be financed from private, loans’ and the EU support funds.

Table 3: Investments’ effectiveness

|

Fixed capital

|

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

|

Long-term assets, balance value |

1210.6 |

. |

. |

. |

. |

1278.6 |

|

Stocks |

58.9 |

. |

. |

. |

. |

164.6 |

|

Received amounts |

167.7 |

. |

. |

. |

. |

301.1 |

|

Payable amounts |

-236.7 |

. |

. |

. |

. |

-336.3 |

|

Flow of ready money from activity |

. |

274.2 |

305.7 |

285.5 |

321.5 |

341.3 |

|

Flow of investment money |

. |

-450.0 |

-550.0 |

0.0 |

0.0 |

0.0 |

|

|

-1200.5 |

-175.8 |

-244.3 |

285.5 |

321.5 |

1749.3 |

|

Average change norm |

9.29% |

|

|

|

|

|

The enterprise could regularly modernize technologies, while purchasing the needed long terms assets and covering other expenses. The enterprise would export part of the manufactured production.

During the period of 2005 – 2010, the received sales and payable loans’ changes are insignificant.

Table 4: Production cost price in 2005-2010

|

Cost, Lt |

2005 |

2006 |

2007 |

2008 |

2009 |

2010 |

|

Raw materials |

161.563 |

184.828 |

324.792 |

468.534 |

538.906 |

630.414 |

|

Wage |

87.514 |

91.890 |

112.360 |

117.978 |

150.132 |

203.585 |

|

Social insurance |

31.593 |

28.486 |

34.832 |

36.573 |

46.541 |

63.111 |

|

Materials |

120.297 |

132.327 |

145.559 |

160.115 |

176.127 |

193.740 |

|

Energy |

12.024 |

13.226 |

14.549 |

16.004 |

17.604 |

19.365 |

|

Transport and fuel |

214.250 |

214.250 |

214.250 |

214.250 |

214.250 |

214.250 |

|

Cost, total, Lt |

627.241 |

665.007 |

846.343 |

1.013.455 |

1.143.561 |

1.324.464 |

It is forecasted that the manufacturing outlays (materials, energy) would increase by 20 per cent annually, the wage and social insurance outlays would increase accordingly to the employees’ number and the growth of wage. The transport expenses would remain unchanged, because the enterprise would not need the appropriate services’ purchase (loan) from other legal entities, therefore the growth of transport expenses would be compensated by the effective use of the transport means.

The increase of the raw materials’ growth is predetermined by the manufacturing susceptible to raw materials and the increasing packing manufacturing volumes.

The energy outlays – electricity and thermal energy.

The risk factor in the activity of JSC “Kaimas”:

- technical risk can be created by bad manufacturing potentials use due to technical malfunctions. This risk can be softened by careful choice of purchased mechanisms and tools: they must be technically reliable and durable;

- commercial risk is related to the decrease of income due to the manufactured production prices’ changes and the markets’ loss. The prices’ increase according to the competition on the market is less likely.

- financial risk is related to the lack of funds needed for the project’s implementation. If the company does not receive the planned financing needed for the project’s implementation, the enterprise will have to look for alternative financing sources.

Conclusions

The analyzed scientific approaches to SME’s support necessity and the Lithuanian government’s approach to SME’s importance for the economy show that support for SME is considered as one of the economic politics’ priorities.

One of the most important requirements for SME enterprises seeking to the EU financial support is the correspondence to the provided economic vitality rates.

The calculated JSC “Kaimas” economic vitality rates correspond to the economy entities seeking to use the general programming document Village development and fishery priority support economic vitality requirements:

- the net profitability rate during the analyzed and the forecasted period exceeds 3 % (critical value), and in 2005 – 2010 between 10.9 % and 12.0 %;

- the average assets’ profitability rate for 2005 – 2010 period exceeds 7 %, it changes from 16.7 % to 14.9 % in the years 2005 – 2010;

- the loan’s rate in the analyzed period does not exceed 0.5% (it changes in the limits from 0.24 to 0.46);

- the loan’s repayment rate for 2005 – 2010 period is higher than 1.25 (in 2005 – 2010 this rates’ values change in the interval from 1.34 to 1.5);

- the general liquidity rate for the forecasted period is higher than 1.2 (for period from 2008 to 2010 its values change in the interval from 1.71 to 3.30), though this rate’s value in 2006 is lower than 1.2, but in the forecasted year it exceeds the critical value;

- the calculated enterprise’s internal profitability norm (VGN) is 9.29 per cent, it is higher than the Lithuanian bank’s reported last artificial year (1 – 5 years) period’s loans’ in Litas average interests’ norm (about 8.13 per cent), but does not exceed 20 %.

The given main financial rates allow to claim that the project is viable and financially beneficial and paying off. The received rates’ values describing the economic vitality are better than critical, therefore JSC “Kaimas” is a suitable applicant for support.

Calculations show that the estimated activity programs implementation will guarantee the profitable activity and will allow to implement all investments dealing with economy modernization.

References

- Armstrong, H., Taylor, J. Regional Economics and Policy. Third edition. Oxford: Blackwell Publishers, 2000, 243 p.

- Bagdzevičienė, R., Krišpinovičius, S. Regionų ekonomikos plėtotės iki 2015 metų strategija // Lietuvos mokslas, Nr. 41, 2003, p. 637 – 671.

- Baňasová, L., Čambál, M., Hrúzová, Z.: Talent management and industrial enterprises in Slovakia. In: Upravlenie ekonomikoj: metody, modeli, technologii. Ufa : UGATU, 2010. - ISBN 978-5-4221-0119-1. - pp. 193-196

- Baršauskas, P. Smulkiojo ir vidutinio verslo politika Europos Sąjungoje ir Lietuvoje. Kaunas: Technologija, 2002, 133 p.

- Bivainis, J. Lyginamieji Lietuvos ekonomikos raidos vertinimai. // Ekonomika, 54, 2001, p. 12.

- Business Demography in Europe // EUROSTAT Statistics. 2002, 15 p.

- Business Vision for Europe: Growth, Jobs and Prosperity for our Future. 2005. Unice, Brussels. Available at: www.unice.org [Retrieved 2008 12 22].

- Čambál, M., Hoghová, K.: Corporate culture application in enterprises as assumption their long-term prosperity. - registrovaný v ISI Proceedings. In: Annals of DAAAM and Proceedings of DAAAM Symposium. - ISSN 1726-9679. Vienna, 2008. s. 0191-0192

- Degutis, A. Laisvosios rinkos idėjos. // Laisvoji rinka, 6, 1997, p. 20 – 21.

10. European Charter for Small Enterprises Report Lithuania – 30/09/2002.

11. Gečas, K., Jakubavičius, A., Vijeikis, D. Struktūrinių fondų parama verslui: galimybės, metodai, patarimai. 2004. Vilnius: UAB „Pačiolis“, p. 15.

12. Global Transformations: Politics, Economics, Culture. / McGreew, D., Goldbaltt, A., Perraton D. J. – London: Polity Press, 2002, 85 p.

13. Hali, R, Smith, A., Tsoukalis, L. Competitiveness and Cohesion in EU Policies. Oxford University Press, 2001, 689 p.

14. Hardwick, P., Khan, B., Langmead, J. An Introduction to Modern Economics. New York: Longman, 1999, 553 p.

15. Kriščiūnas, K., Greblikaitė, J. Entrepreneurship in Sustainable Development: SMEs Innovativeness in Lithuania. // Engineering Economics, 2007, No. 4 (54).

16. Let SME’s grow: European SME’s Speak out their Need for Growth. 2005. [Retrieved 2008 12 16]. Available at: http://www.unice.org/content/default.asp?PageID=84

17. Masalskis, K. Smulkiojo ir vidutinio verslo plėtros institucijos: dabartis ir perspektyvos. // Organizacijų vadyba: sisteminiai tyrimai, 7, 1998, p. 98-107.

18. Melnikas, B. New Challenges for the Cultural and Economic Development in the European Union: the Long Term Transformations. // Engineering Economics, 2007, No. 2 (52).

19. Misesas, L. Ekonominė politika: mintys šiandienai ir rytdienai. Kaunas, 1992, p. 38.

20. Ross, S. A.,Westerfield, R. W.,Jaffe, J. Corporate Finance. – Lisbon: McGraw-Hill, 2001, 960 p.

21. Schiemann, M. Enterprises in Europe – Does Size Matter? // Eurostat Statistics in Focus. Theme 4/39.1, 2002, 7 p.

22. Skietrys, E., Raipa, A., Bartkus, E. V. Dimensions of the Efficiency of Public – Private Partnership. // Engineering Economics, 2008, No. 3 (58).

23. SME’s in Europe – Candidate Countries. European Commision. Luxembourg: Office for Official Publications of the European Communities, 2003.

24. SMEs in Focus: Main Results from the 2002 Observatory of European SMEs // EUROSTAT statistics. 2002, 15 p.

25. Snieška, V. Research into International Competitiveness in 2000 – 2008 // Engineering Economics, 2008, No. 4 (59).

26. Stripeikis, O., Žukauskas, P. Smulkiojo ir vidutinio verslo aplinka Lietuvos ir ES rinkose. // Organizacijų vadyba: sisteminiai tyrimai, 31, 2004, p. 209.

27. Trebuňa, P., Pekarčíková, M., Mihok, J.: The draft general model code of conduct. In: Annual scientific bulletin of plant- economic department of the european wood technology university studies. no. 24 (2008), p. 142-144. ISSN 1640-3622.

28. Sūdžius, V. Smulkiojo ir vidutinio verslo administravimas ir valdymas. Vilnius: Kronta, 2001,

29. World Development Report // The State in a Changing World. Oxford University Press, 1997, p. 15 – 21.

TEXT: Prof. Teodoras Tamošiūnas, Saulius Lukošius, Lithuania